The house is actually the first foundation to have an exclusive Lender to approve the loan

- Located area of the possessions

- Deposit (if you find yourself to order a house), or even the amount of Equity in your home (when you are refinancing).

- Your general monetary photo

The original concern an exclusive Lender requires is the fact Is anything make a mistake, can which possessions retain its worthy of? In the event the house is for the good condition plus in a hot market, its felt more secure, and a personal Mortgage lender is far more probably provide up against that assets.

Like, one detached domestic in a good subdivision inside the Oakville, Ontario is far more trendy to possess a private Financial than just a custom-founded cottage from inside the Northern Ontario. It doesn’t mean that you never get a private financial on the a bungalow, nevertheless ount. Continued about analogy, in the event that one another properties can be worth $five-hundred,000, a personal Lender can be happy to lend $400,000 toward Oakville possessions, but only $350,000 into the bungalow.

For homebuyers, downpayment ‘s the level of their coupons you add down when purchasing a house. Having residents, family security will be your household really worth without having the established mortgage into the your house. Private loan providers choose consumers to possess at the very least fifteen-20% away from down-payment otherwise household security.

- Analogy to have home buyers: If you are searching to acquire a home $five-hundred,000 in the any place in Ontario, you need at the least $75,000 so you’re able to $100,000 given that deposit. Shortly after appointment the minimum deposit demands, the greater down-payment you have, the reduced the speed. Having more than 20% advance payment helps you reduce your private home loan speed significantly.

- Example to have residents: If you’re within the Ontario and you can individual an excellent $800,000 family, we can provide you to 85% of your property worth, we.e., home financing around $680,000. For individuals who currently have a first financial from $eight hundred,000, we are able to offer you a second financial up to $280,000 ($680,000 $400,000).

What is important regarding the total monetary picture is to try to keeps a keen get off bundle. Personal Mortgage loans usually are short-title answers to help you increase funds. Thus, Private Loan providers want to see what your much time game are.

Searching to make use of the loan to repay loans and increase the borrowing? Going to upgrade your house market it during the an effective price? Otherwise are you presently going to use it for real estate investment? Its critical to features an obvious monetary bundle one which just chat in order to a private Bank.

Personal Loan providers would take earnings, credit rating, and you will financial investments under consideration. They would like to ensure that your earnings is enough to protection the brand new mortgage repayment. However, these issues does not make-or-break a great deal. Greatest credit score or more income can potentially help you get a diminished home loan rates.

Is there at least credit score for personal home loan?

Zero. There isn’t any lowest credit score to have Individual Loan providers in the Ontario. Providing you have sufficient advance payment otherwise household equity, you can get approved that have poor credit or no borrowing.

instant same day payday loans online Vermont

How much time can it try become approved?

It can be as fast as a couple of hours if you are able to provide every piece of information called for. An average of it will require step 1-three days discover an acceptance.

Just what files can i get a private mortgage when you look at the Ontario?

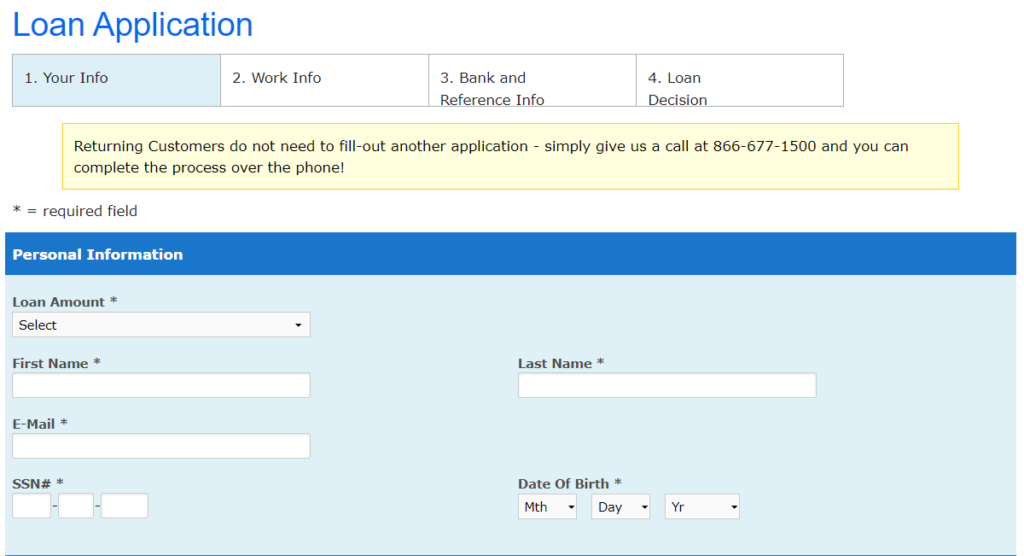

- Fill in a primary on the web application

- Evidence of title, elizabeth.grams. 2 items of ID’s

- Having family pick: Get and you may Profit Arrangement, Mls Listing, and you may proof advance payment

- For domestic re-finance: Assets Goverment tax bill, and you may current Financial Report